Renters Insurance in and around Lansing

Looking for renters insurance in Lansing?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Your possessions are valuable and so is their safety. Doing what you can to keep it safe just makes sense! Your next right step is getting renters insurance from State Farm. A State Farm renters insurance policy can protect your possessions, from your laptop to your coffee maker. Unsure how to choose a level of coverage? No problem! Jennifer Blumer stands ready to help you assess your needs and help select the right policy today.

Looking for renters insurance in Lansing?

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

Renting is the smart choice for lots of people in Lansing. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover repairs for tornado damage to the roof or smoke damage to the walls, who will repair or replace your belongings? Finding the right coverage helps your Lansing rental be a sweet place to be. State Farm has coverage options to match your specific needs. Fortunately you won’t have to figure that out on your own. With personal attention and fantastic customer service, Agent Jennifer Blumer can walk you through every step to help you helps you identify coverage that guards the rental you call home and everything you’ve invested in.

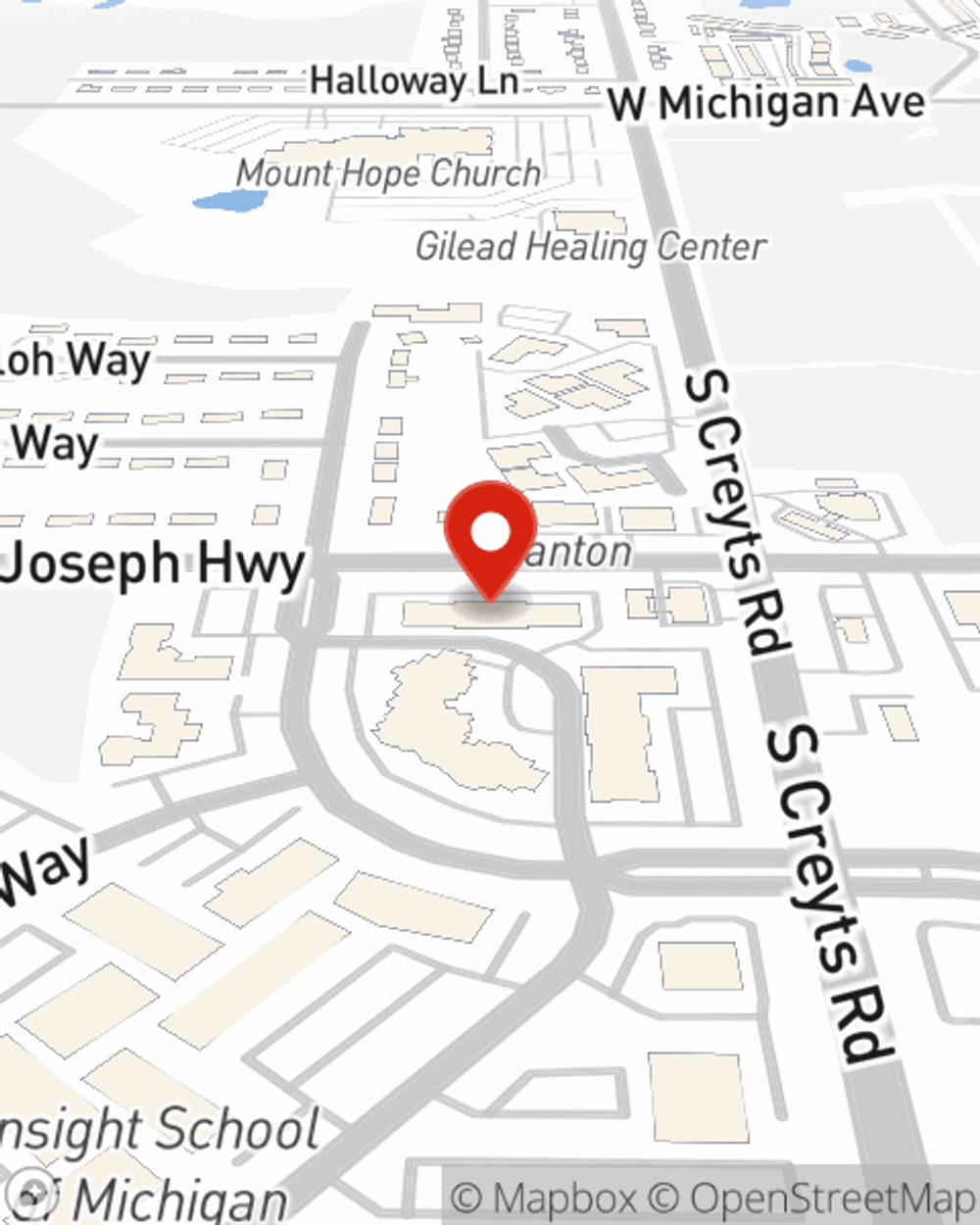

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Lansing. Contact agent Jennifer Blumer's office for more information on a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Jennifer at (517) 372-0200 or visit our FAQ page.

Simple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Jennifer Blumer

State Farm® Insurance AgentSimple Insights®

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.